$SPX (Yearly, log scale) Because the 2021 accomplished, it solely becoming that we have a look at the yearly candle and the place we stand traditionally. Each the yearly traditionally has proven long run market route as we will see from the chart beneath. We closed at or close to a real life time channel prime that extends from 1893 with RSI over 87 following a 9 12 months rally after the yearly breakout in 2013. Might this 12 months be the beginning of a retracement downward and the beginning of a multi-year bear market? As with all particular person chart of their respective timeframes, objectively have a look at this chart, the probabilities are excessive.

$SPX (month-to-month, log scale) Month-to-month candle held beneath 12year channel resistance in addition to the channel extension from 2003. RSI destructive divergence stays in play. So long as these channels proceed to carry, will probably be troublesome to push into new ATHs with out some important retracement or multi-month consolidation.

Now lets have a look at the brief time period arithmetic scale channels…

$SPX (weekly, arithmetic scale) rejected on the channel resistance with destructive RSI divergence

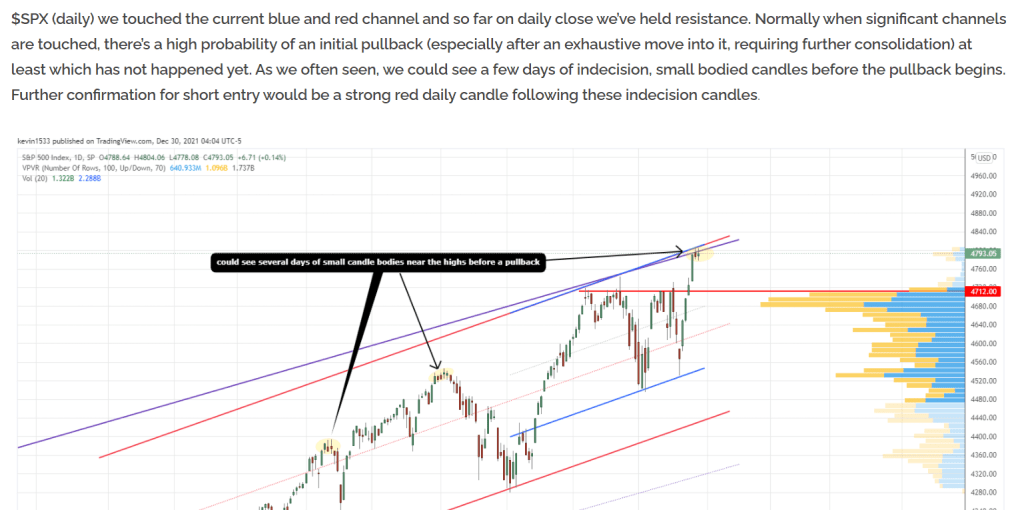

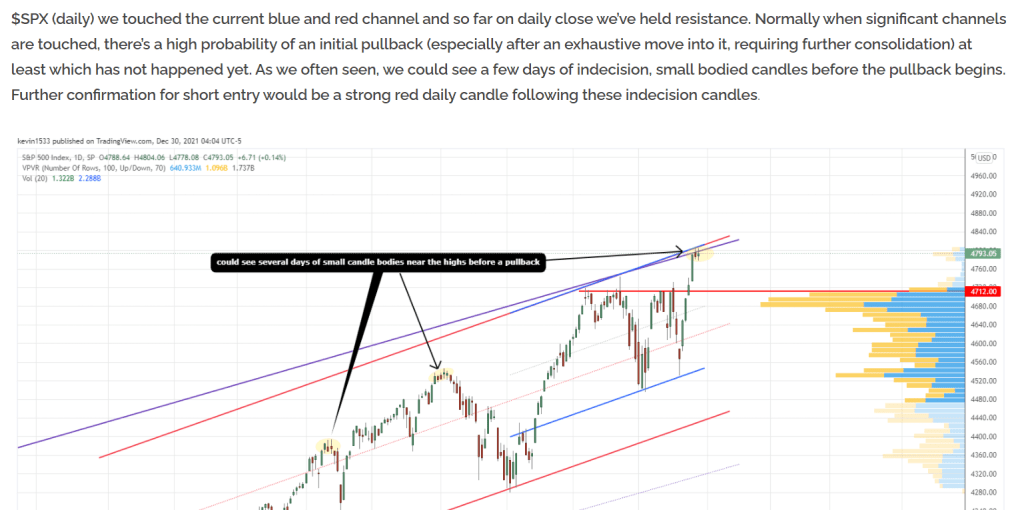

$SPX (day by day) Up to now we acquired the small our bodies candles at channel resistance with bearish engulfing candle on Thursday after which follow-through candle down on Friday. Would count on a transfer all the way down to the backtest of 4712 degree which is the bullish breakout degree. If bulls cant defend there and we get a false breakout reversal beneath, it might open up sturdy momentum to the draw back.

From Thursday AM E-newsletter

$ES_F (day by day) futures at the moment at day by day provide

$QQQ (weekly) to date we had the channel rejection plus false breakout reversal again in November. Following month lengthy consolidation beneath, bulls made one other push after resistance and failed with a taking pictures star to shut the 12 months. Bears proceed to be in management as they’ve defended the place wanted. Query is do they lastly take management with 5/9/20ema weekly converged

$IWM (weekly) rallied into prior uptrend line assist(not resistance) and rejected there together with 9/20ema,sma resistance. Technically ought to see a transfer again downwards. Shut beneath 208 ought to open the doorways for the bears.

$DJI (month-to-month) closed at channel resistance with destructive RSI divergence

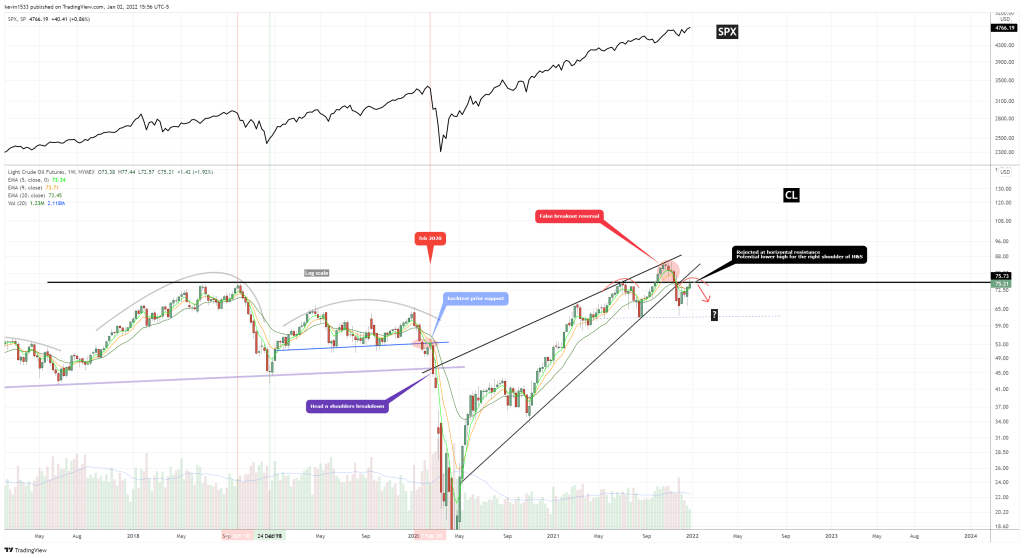

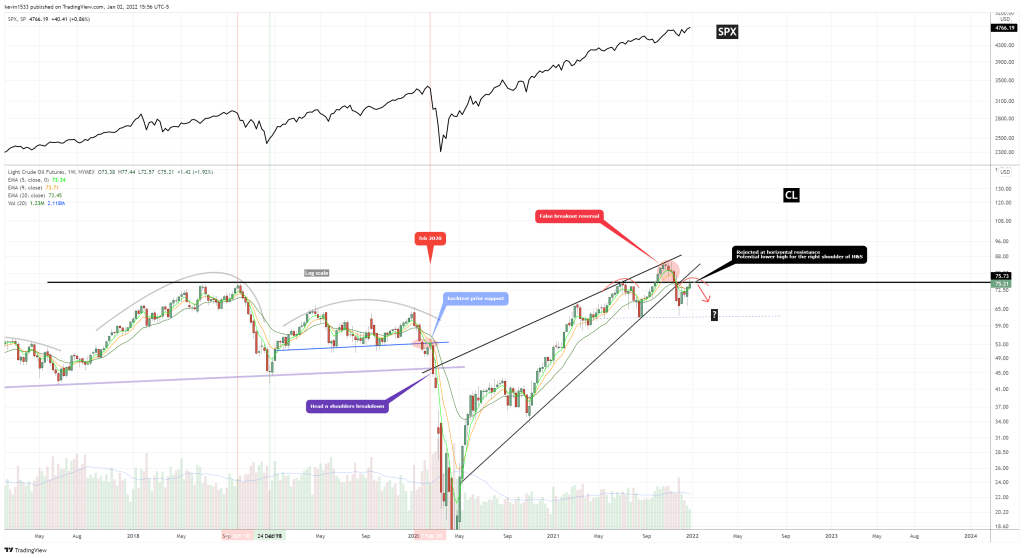

$CL oil futures (weekly) Bearish Head and shoulders in play as we acquired the rejection on the horizontal resistance for potential decrease excessive. Larger image we to date have the false breakout reversal and main wedge breakdown and at the moment a reduction bounce.

$HGX Housing sector (day by day) closed at resistance with destructive divergence

$IBB (weekly) Rejected off the backtest and closed blow 5/9ema.

$SMH semis (month-to-month) hanging man and inside bar at ATHs at 9year channel resistance with destructive RSI divergence

$XLE power (month-to-month) coming off the month-to-month darkish cloud cowl reversal of main pattern line resistances. At the moment in ascending wedge consolidation. Bears in management

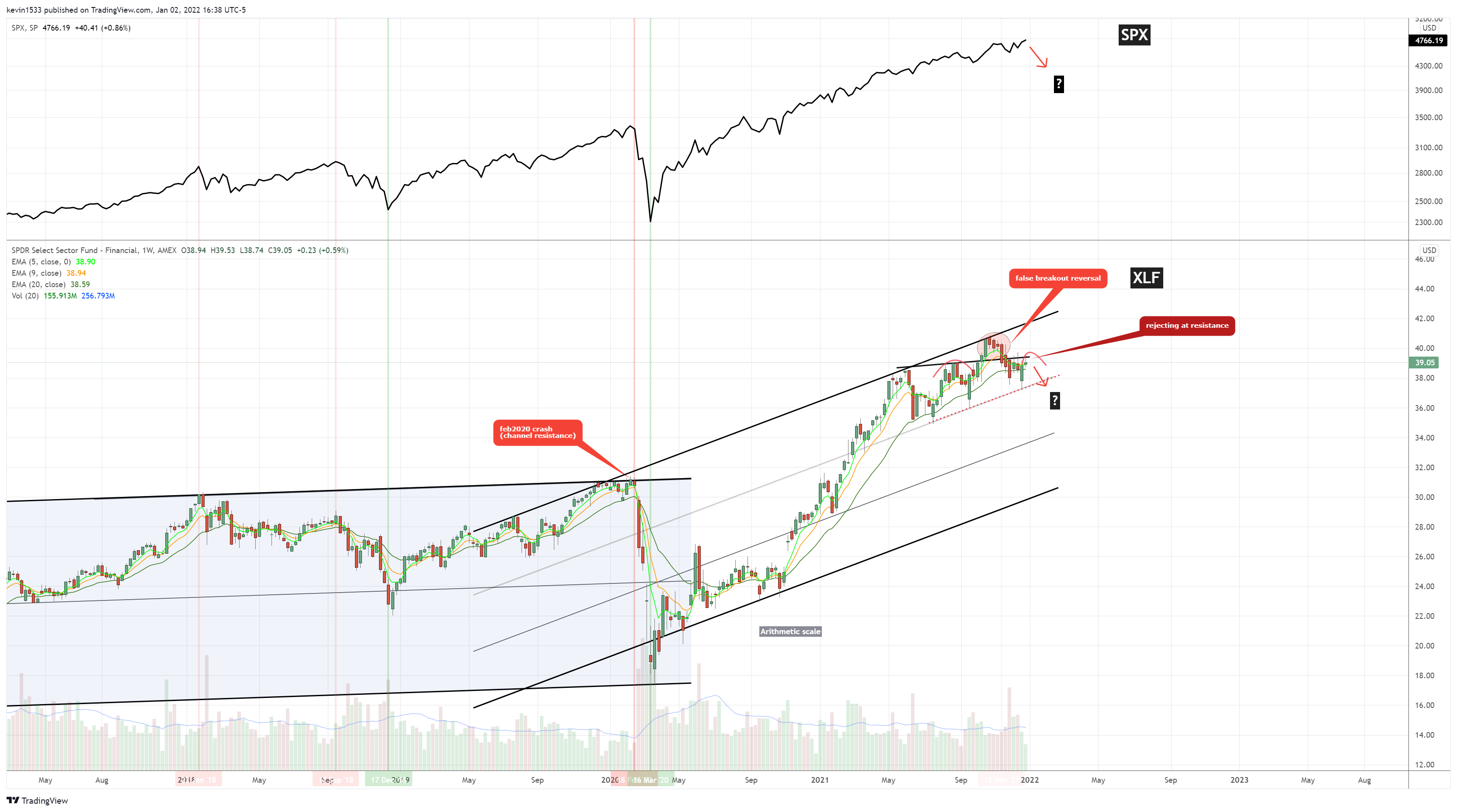

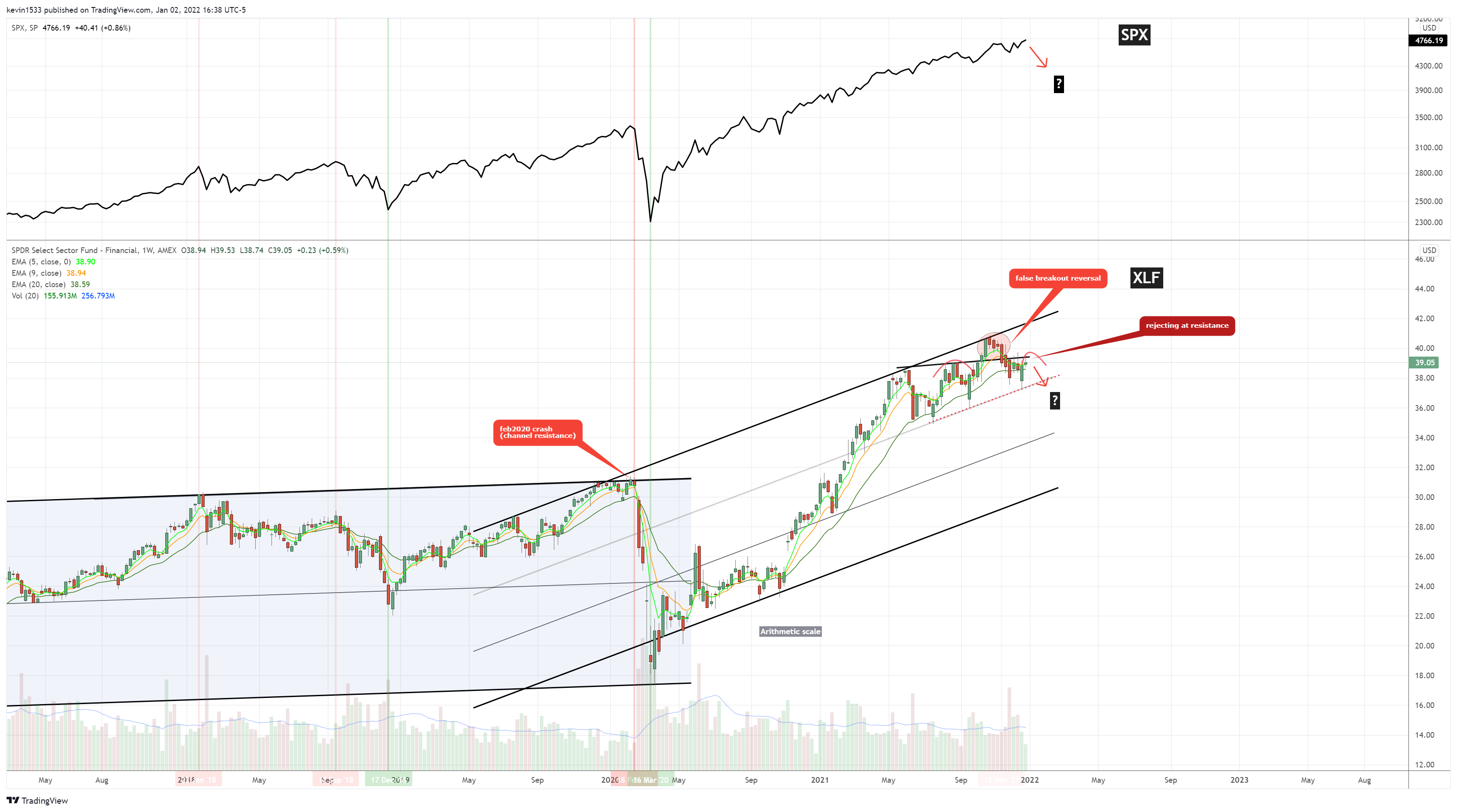

$XLF monetary (weekly) 5/9/20ema converged. Stays weak because it continues to reject at resistance following the false breakout reversal. Potential decrease excessive and proper shoulder of H&S

$XLP client staples (month-to-month) closed above channel and ascending wedge resistance. Up to now no bearish sign right here.

KWEB China web ETF (month-to-month) closed beneath main trendline/channel assist

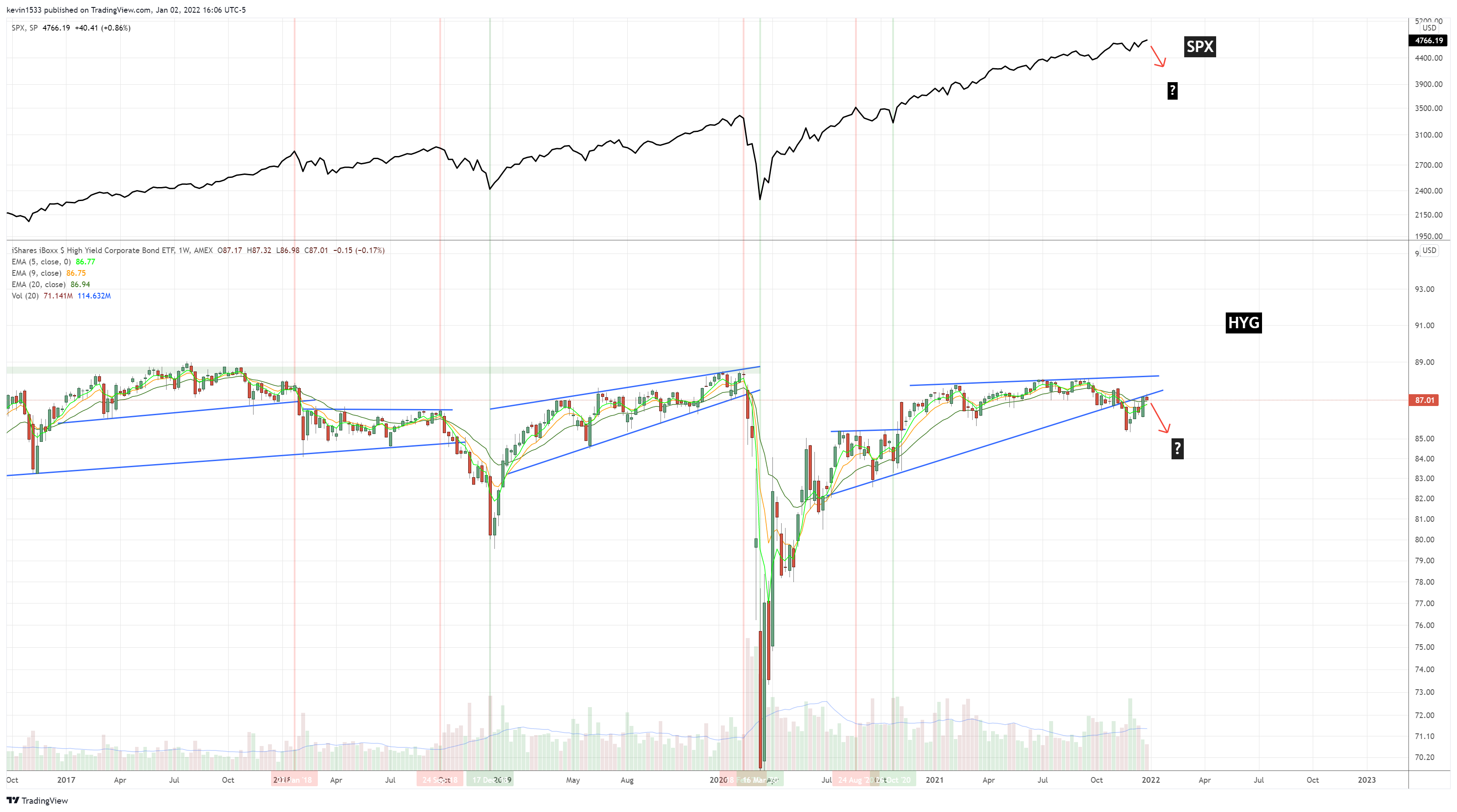

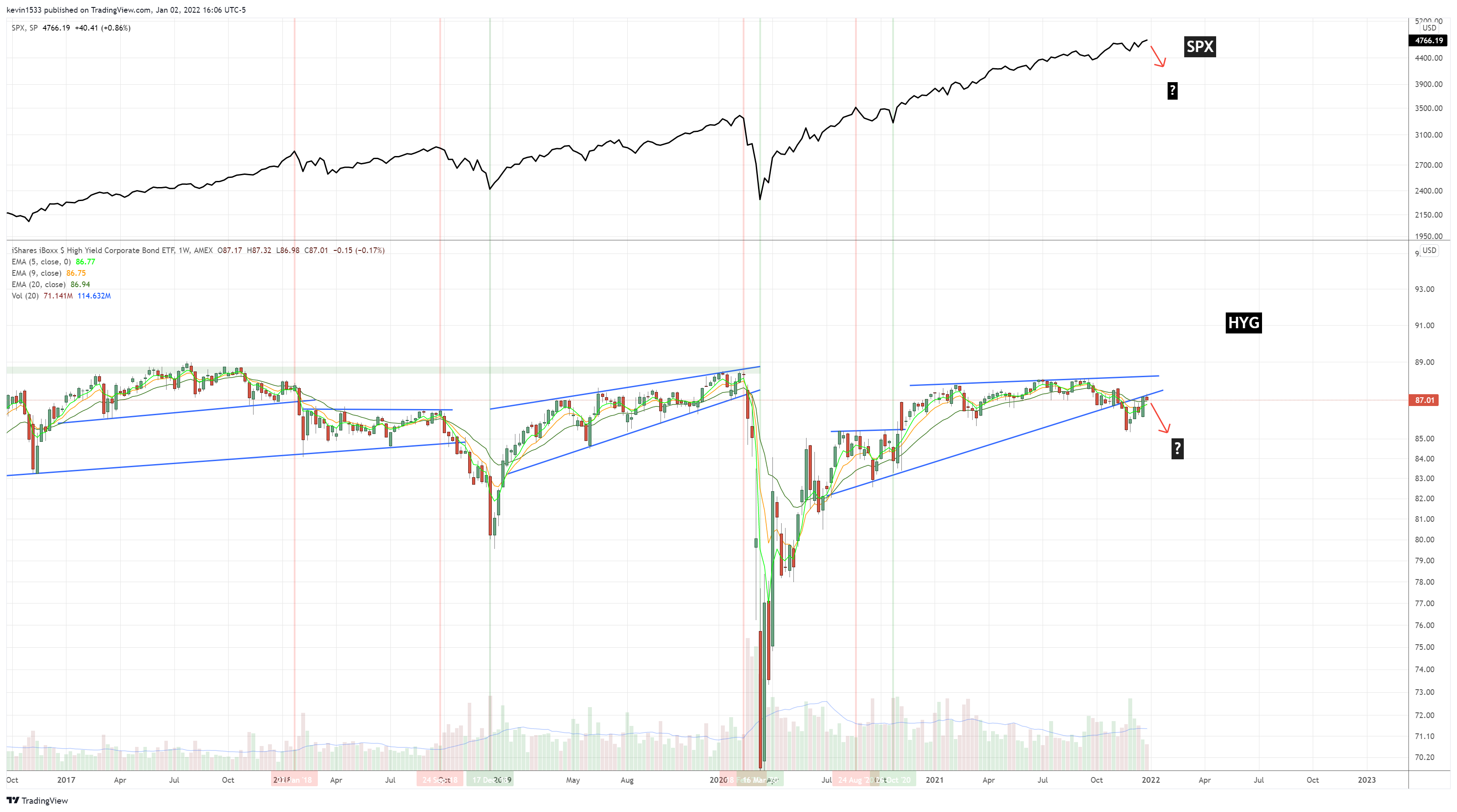

$HYG Excessive yield corp bond(weekly) at pattern line resistance with 5/9/20ema converged.

$TLT (weekly) Held breakout backtest assist and weekly 20ema/sma assist.

$BTC (weekly, arithmetic scale) beneath weekly 5/9/20ema and channel assist. Might finally head all the way down to the sturdy demand degree at 34259

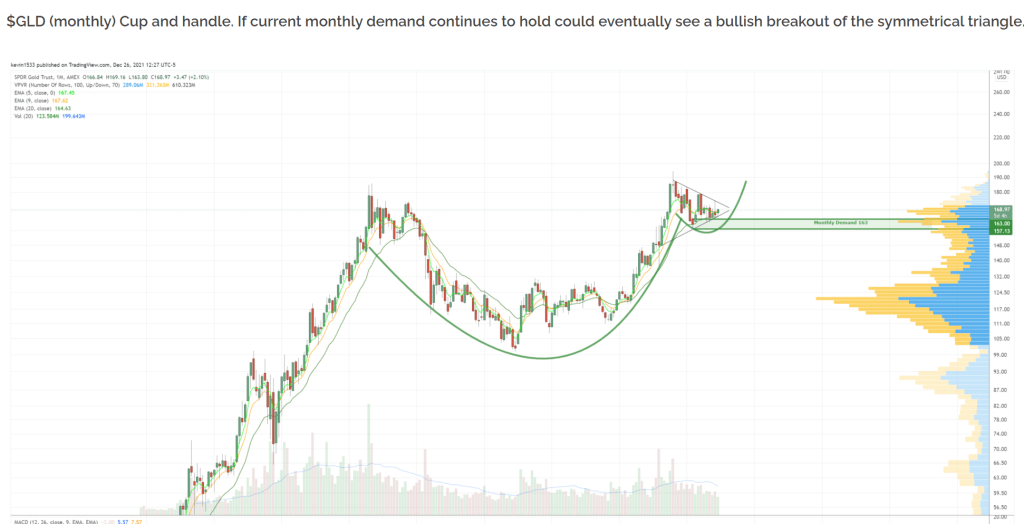

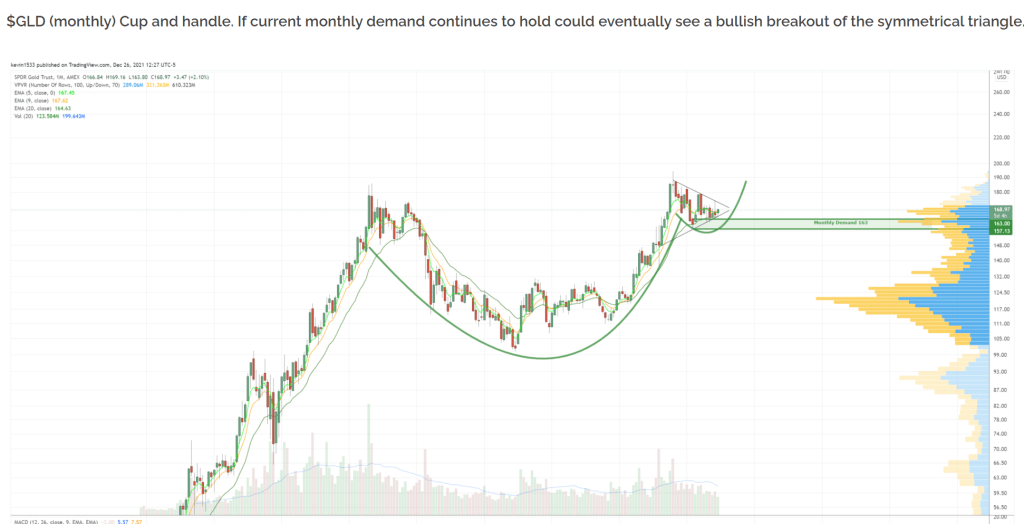

$GLD (month-to-month) with a robust shut above 5/9/20ema following consolidation over month-to-month demand.

from 12/26/2021 publication

Let’s Take a look at the chief

$AAPL (weekly) Dark cloud cover off main channel resistance after which the inexperienced candle this week adopted by taking pictures star rejection off channel resistance. Till we get a weekly shut above the crimson candle to negate the reversal, bears are in management.

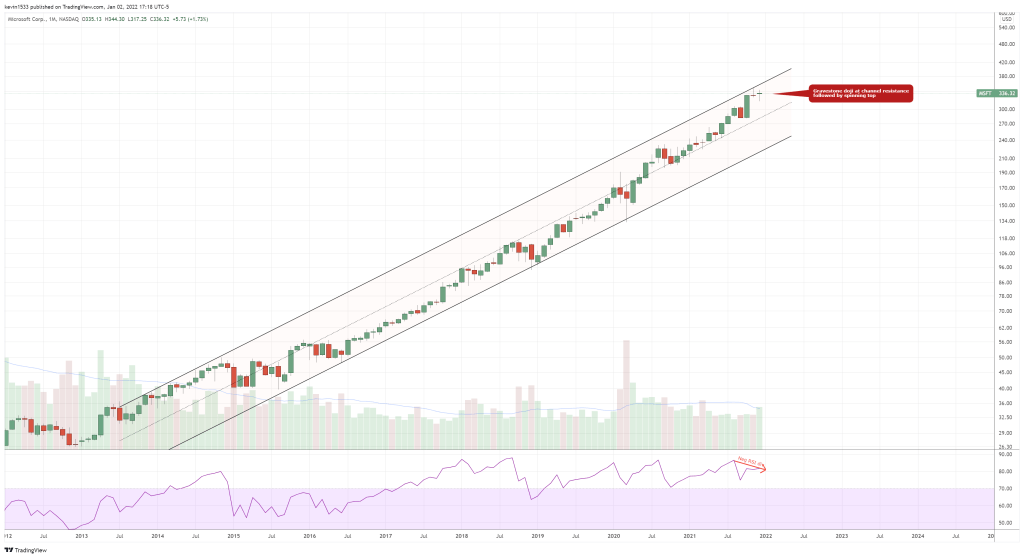

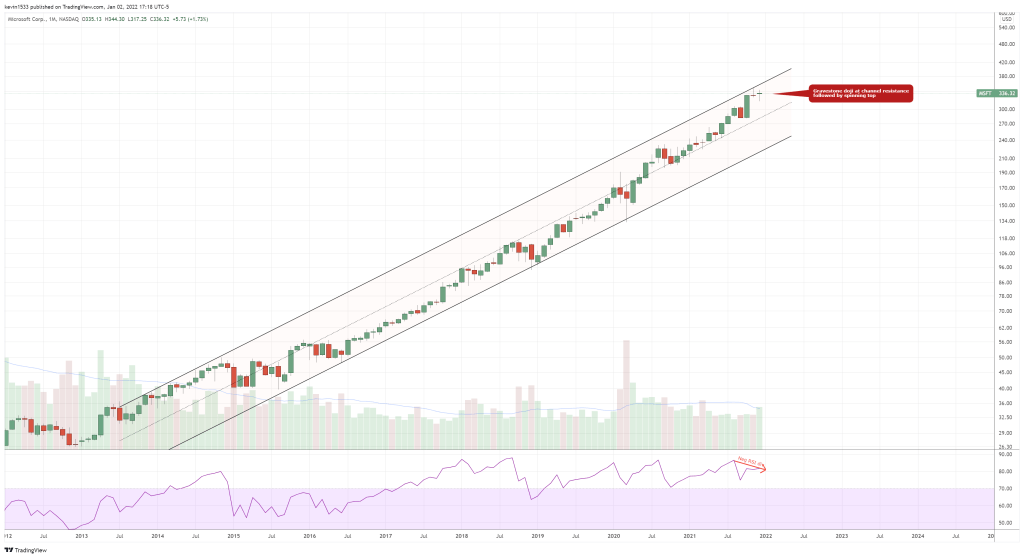

$MSFT (month-to-month) November month-to-month candle was a headstone doji at ATHs, rejecting on the 9 12 months channel prime. December month-to-month candle was a spinning prime(indecision, and potential reversal sign as properly. Destructive RSI divergence in play.

$GOOGL (month-to-month) Harami on the prime of 13 12 months channel. If the resistance holds and we resolve to the draw back, MACD able to gasoline a robust transfer.

$GOOGL (day by day) following bearish engulfing rejection at brief time period downtrend channel, closed beneath 5/9/20ema converged

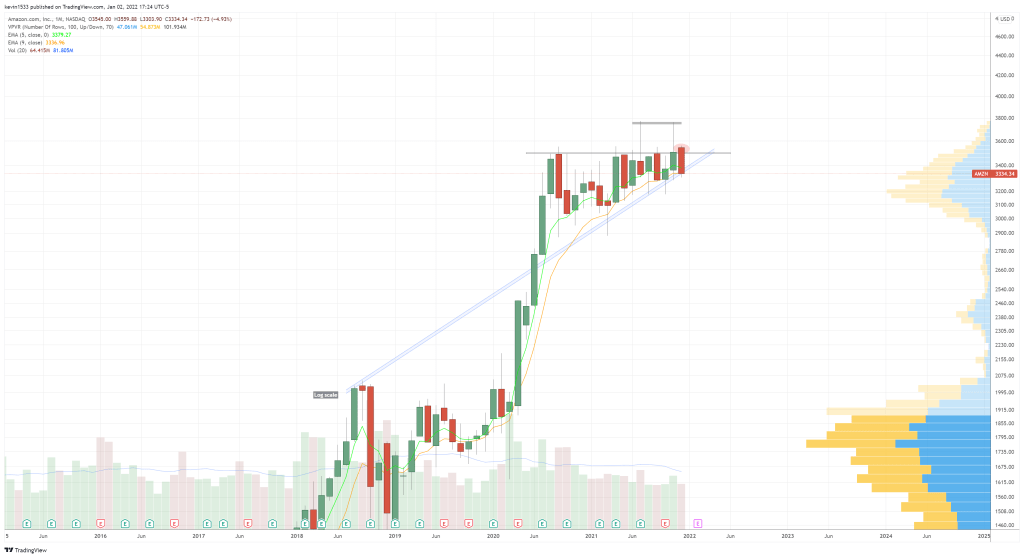

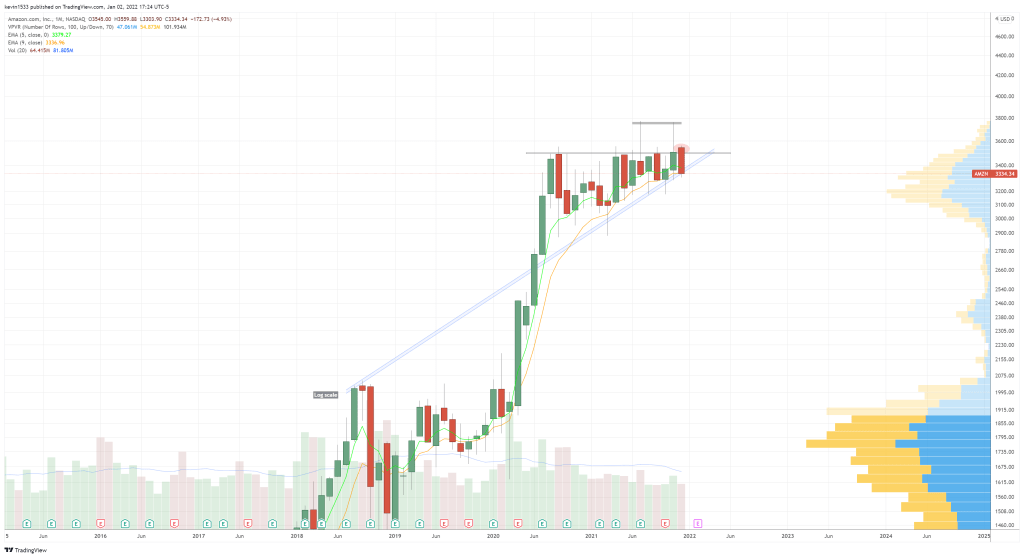

$AMZN (month-to-month) failed breakout reversal with 5/9ema converged. Bears have the sting.

$AMZN (weekly) Up to now double prime and failed breakout and now rejected at 5/9/20ema converged resistance with shut again beneath uptrend line resistance

$TSLA (month-to-month) Doji at main channel resistance at ATHs. Let’s see if present month-to-month candle confirms a bearish reversal. RSI destructive divergence in play.

$FB (month-to-month) Bearish engulfing at main channel resistance remains to be the dominant energetic sign. Month-to-month 5/9/20ema converged

$NVDA (month-to-month) rejection at twin channel resistance

Many of the setups are demand/lengthy setups. Keep in mind you could be a bearish outlook out there and nonetheless daytrade these ranges once they set off for intraday good points. Keep in mind to at all times evaluation prior triggered setups and see how they react.

$AAPL (day by day) lengthy setup at 164.02 and 150.37

$ADBE (4H) lengthy setup at 516.58

$AMC (day by day) lengthy setup at 12.61

$AMD (day by day) lengthy setup at 120.95

$BA (day by day) lengthy setup at 178.95

$CAT (day by day) lengthy setup at 190.50

$DIS (weekly) lengthy setup at 141.57-141.74

$EBAY (day by day) lengthy setup at 61.52

$FB (day by day ) lengthy setup at 290.45-289.83 and 281

$GM (day by day) lengthy setup at 49.57

$HD (day by day) lengthy setup at 374.39

$INTC (day by day) Lengthy setup at 49.91

$JMIA (day by day) lengthy setup at 8.11

$LCID (day by day) lengthy setup at 27.69

$M (day by day) lengthy setup at 22.85

$MSFT (day by day) lengthy setup at 311 and 295.34

$MA (day by day) lengthy setup at 341.24

$MSFT (day by day) Lengthy setups at 320, 311, 295.34

$NFLX (day by day) lengthy setup at 550.16

$NKE (4h) lengthy setup at 152.42

$NVDA (day by day) lengthy setup at 266.70 and 228.23

$ORCL (day by day) lengthy setup at 78.54

$PDD (day by day) lengthy setup at 49.65

$PTON (day by day) lengthy setup at 32.44

$QCOM (day by day) lengthy setup at 165

$QQQ (day by day) lengthy setup at 359.88 and 343.63

$ROKU (day by day) lengthy setup at 165.23

$SHOP (4H) lengthy setup at 1238

$SPX (day by day) lengthy setup at 4588 and 4368.3

$TDOC (day by day) lengthy setup at 85.92

$TGT (4h) lengthy setup at 207.20

$TLRY (day by day) lengthy setup at 6.29

$TSLA (day by day) lengthy setup at 910.70

$TTD (day by day) lengthy setup at 73 and 61.81

$UAA (day by day) lengthy setup at 17.66

$V (day by day) lengthy setup at 209.09 and 198.27

$WDC (day by day) lengthy setup at 55.96

$XOM (day by day) lengthy setup at 54.37

$ZM (4H) lengthy setup at 167.14

Like Loading…

$SPX (month-to-month, log scale) Month-to-month candle held beneath 12year channel resistance in addition to the channel extension from 2003. RSI destructive divergence stays in play. So long as these channels proceed to carry, will probably be troublesome to push into new ATHs with out some important retracement or multi-month consolidation.

Now lets have a look at the brief time period arithmetic scale channels…

$SPX (weekly, arithmetic scale) rejected on the channel resistance with destructive RSI divergence

$SPX (day by day) Up to now we acquired the small our bodies candles at channel resistance with bearish engulfing candle on Thursday after which follow-through candle down on Friday. Would count on a transfer all the way down to the backtest of 4712 degree which is the bullish breakout degree. If bulls cant defend there and we get a false breakout reversal beneath, it might open up sturdy momentum to the draw back.

From Thursday AM E-newsletter

$ES_F (day by day) futures at the moment at day by day provide

$QQQ (weekly) to date we had the channel rejection plus false breakout reversal again in November. Following month lengthy consolidation beneath, bulls made one other push after resistance and failed with a taking pictures star to shut the 12 months. Bears proceed to be in management as they’ve defended the place wanted. Query is do they lastly take management with 5/9/20ema weekly converged

$IWM (weekly) rallied into prior uptrend line assist(not resistance) and rejected there together with 9/20ema,sma resistance. Technically ought to see a transfer again downwards. Shut beneath 208 ought to open the doorways for the bears.

$DJI (month-to-month) closed at channel resistance with destructive RSI divergence

$CL oil futures (weekly) Bearish Head and shoulders in play as we acquired the rejection on the horizontal resistance for potential decrease excessive. Larger image we to date have the false breakout reversal and main wedge breakdown and at the moment a reduction bounce.

$HGX Housing sector (day by day) closed at resistance with destructive divergence

$IBB (weekly) Rejected off the backtest and closed blow 5/9ema.

$SMH semis (month-to-month) hanging man and inside bar at ATHs at 9year channel resistance with destructive RSI divergence

$XLE power (month-to-month) coming off the month-to-month darkish cloud cowl reversal of main pattern line resistances. At the moment in ascending wedge consolidation. Bears in management

$XLF monetary (weekly) 5/9/20ema converged. Stays weak because it continues to reject at resistance following the false breakout reversal. Potential decrease excessive and proper shoulder of H&S

$XLP client staples (month-to-month) closed above channel and ascending wedge resistance. Up to now no bearish sign right here.

KWEB China web ETF (month-to-month) closed beneath main trendline/channel assist

$HYG Excessive yield corp bond(weekly) at pattern line resistance with 5/9/20ema converged.

$TLT (weekly) Held breakout backtest assist and weekly 20ema/sma assist.

$BTC (weekly, arithmetic scale) beneath weekly 5/9/20ema and channel assist. Might finally head all the way down to the sturdy demand degree at 34259

$GLD (month-to-month) with a robust shut above 5/9/20ema following consolidation over month-to-month demand.

from 12/26/2021 publication

Let’s Take a look at the chief

$AAPL (weekly) Dark cloud cover off main channel resistance after which the inexperienced candle this week adopted by taking pictures star rejection off channel resistance. Till we get a weekly shut above the crimson candle to negate the reversal, bears are in management.

$MSFT (month-to-month) November month-to-month candle was a headstone doji at ATHs, rejecting on the 9 12 months channel prime. December month-to-month candle was a spinning prime(indecision, and potential reversal sign as properly. Destructive RSI divergence in play.

$GOOGL (month-to-month) Harami on the prime of 13 12 months channel. If the resistance holds and we resolve to the draw back, MACD able to gasoline a robust transfer.

$GOOGL (day by day) following bearish engulfing rejection at brief time period downtrend channel, closed beneath 5/9/20ema converged

$AMZN (month-to-month) failed breakout reversal with 5/9ema converged. Bears have the sting.

$AMZN (weekly) Up to now double prime and failed breakout and now rejected at 5/9/20ema converged resistance with shut again beneath uptrend line resistance

$TSLA (month-to-month) Doji at main channel resistance at ATHs. Let’s see if present month-to-month candle confirms a bearish reversal. RSI destructive divergence in play.

$FB (month-to-month) Bearish engulfing at main channel resistance remains to be the dominant energetic sign. Month-to-month 5/9/20ema converged

$NVDA (month-to-month) rejection at twin channel resistance

Many of the setups are demand/lengthy setups. Keep in mind you could be a bearish outlook out there and nonetheless daytrade these ranges once they set off for intraday good points. Keep in mind to at all times evaluation prior triggered setups and see how they react.

$AAPL (day by day) lengthy setup at 164.02 and 150.37

$ADBE (4H) lengthy setup at 516.58

$AMC (day by day) lengthy setup at 12.61

$AMD (day by day) lengthy setup at 120.95

$BA (day by day) lengthy setup at 178.95

$CAT (day by day) lengthy setup at 190.50

$DIS (weekly) lengthy setup at 141.57-141.74

$EBAY (day by day) lengthy setup at 61.52

$FB (day by day ) lengthy setup at 290.45-289.83 and 281

$GM (day by day) lengthy setup at 49.57

$HD (day by day) lengthy setup at 374.39

$INTC (day by day) Lengthy setup at 49.91

$JMIA (day by day) lengthy setup at 8.11

$LCID (day by day) lengthy setup at 27.69

$M (day by day) lengthy setup at 22.85

$MSFT (day by day) lengthy setup at 311 and 295.34

$MA (day by day) lengthy setup at 341.24

$MSFT (day by day) Lengthy setups at 320, 311, 295.34

$NFLX (day by day) lengthy setup at 550.16

$NKE (4h) lengthy setup at 152.42

$NVDA (day by day) lengthy setup at 266.70 and 228.23

$ORCL (day by day) lengthy setup at 78.54

$PDD (day by day) lengthy setup at 49.65

$PTON (day by day) lengthy setup at 32.44

$QCOM (day by day) lengthy setup at 165

$QQQ (day by day) lengthy setup at 359.88 and 343.63

$ROKU (day by day) lengthy setup at 165.23

$SHOP (4H) lengthy setup at 1238

$SPX (day by day) lengthy setup at 4588 and 4368.3

$TDOC (day by day) lengthy setup at 85.92

$TGT (4h) lengthy setup at 207.20

$TLRY (day by day) lengthy setup at 6.29

$TSLA (day by day) lengthy setup at 910.70

$TTD (day by day) lengthy setup at 73 and 61.81

$UAA (day by day) lengthy setup at 17.66

$V (day by day) lengthy setup at 209.09 and 198.27

$WDC (day by day) lengthy setup at 55.96

$XOM (day by day) lengthy setup at 54.37

$ZM (4H) lengthy setup at 167.14

Like this:

Like Loading…